Building an ISA Interest Calculator

When we set out to build what we believe is the most accurate ISA calculator in the UK, we wanted it to do more than just multiply your deposit by an interest rate. We wanted to give everyday savers and investors a truly holistic tool—one that factors in how interest rates can change over time, how promotional rates might suddenly drop, how monthly contributions actually compound, and even how your own situation (like whether you’re transferring from another ISA or using this one for the very first time) can affect your final outcome.

In this article, we’ll walk you through the key factors we took into account when we created our calculator, and why we think those details matter for anyone looking to maximise their ISA savings.

Before we dive in, here’s a quick note on what we won’t be talking about: the underlying code or any technical implementation details. We’re focusing squarely on the real-world, practical factors we considered while developing this tool. That means you’ll see us discussing everything from the Bank of England base rate to monthly compounding to transferring your ISA between providers, but we’re not going to talk about code.

We want you to understand how we aimed to deliver a robust, “real world” calculation engine for your ISA forecasts—no matter whether you’re going for a Cash ISA or a Stocks & Shares ISA.

Why a better ISA calculator matters

When we first began brainstorming, we noticed something surprising: most ISA calculators available online tend to be oversimplified. They often ask for just your deposit, an interest rate, and a number of years, then spit out a final figure. That approach might be fine if you’re depositing a single lump sum into a guaranteed fixed-rate ISA and never touching it again. But what about:

- monthly contributions

- variable interest rates

- promotional rates that only last a few months

- the difference between a new ISA and a transferred ISA

We realised the standard “plug-and-chug” approach ignores these details. Our goal was to fill the gap. To us, creating an ISA calculator that properly accounts for these complexities is crucial, because real-life savers rarely fit into a neat, one-size-fits-all box.

Factoring in base rates and shifting interest rates over time

We all know that the Bank of England sets a base rate that influences mortgage rates, loan rates, and yes, savings account rates too. This base rate changes periodically, often in response to economic conditions or inflation targets. We also know that many providers tailor their variable ISA rates to move (roughly) with that base rate. As of this writing, the base rate is around 4.5%. But if inflation edges down and the government wants to cool things off, we might see a sequence of 0.5% rate reductions year-on-year—eventually bringing the base rate closer to 2% over several years.

In our calculator, we wanted to reflect this more dynamic approach to interest. Instead of forcing you to assume a single interest rate for the entire duration, we give you an option to factor in variable scenarios. If you think the base rate will drop 0.5% every year for the next four years, you can see how that drop would affect your final balance. This is especially useful if you’re comparing the “what if” of locking in a one-year or two-year fixed ISA at, say, 4.0% with the possibility of a variable ISA that starts at 4.0% but steadily declines to 2.0%. In short, we don’t want you to be caught off guard by changes in the macroeconomic environment.

How we handle promotional rates / boosted ISA rates

We also noticed many ISA products advertise an enticing promotional rate for, say, the first 6 or 12 months, which then drops significantly. Some banks might start you off at 4.5%, only to revert to a 2.0% “standard” rate after the promo period ends. In a typical calculator, you’d either see the 4.5% rate used the whole time (over-inflating your final number) or you’d use a 2.0% rate from the start (underestimating). Our calculator addresses this common real-world nuance by letting you specify the length of the promotional period and the promotional rate itself.

So, for instance, if your chosen account has a 12-month bonus rate of 4.5% but then slides back to a standard 3.0% rate after that first year, you can plug in both numbers. Our engine will apply the 4.5% for exactly 12 months, then continue the calculation with 3.0% for the remaining duration. This means you’ll get a projection that’s far closer to reality than the simplistic “4.5% forever” approach. And if you pair that with monthly contributions, you’ll see how each deposit after that first year only gets the 3.0% rate (or whatever variable figure you’ve selected).

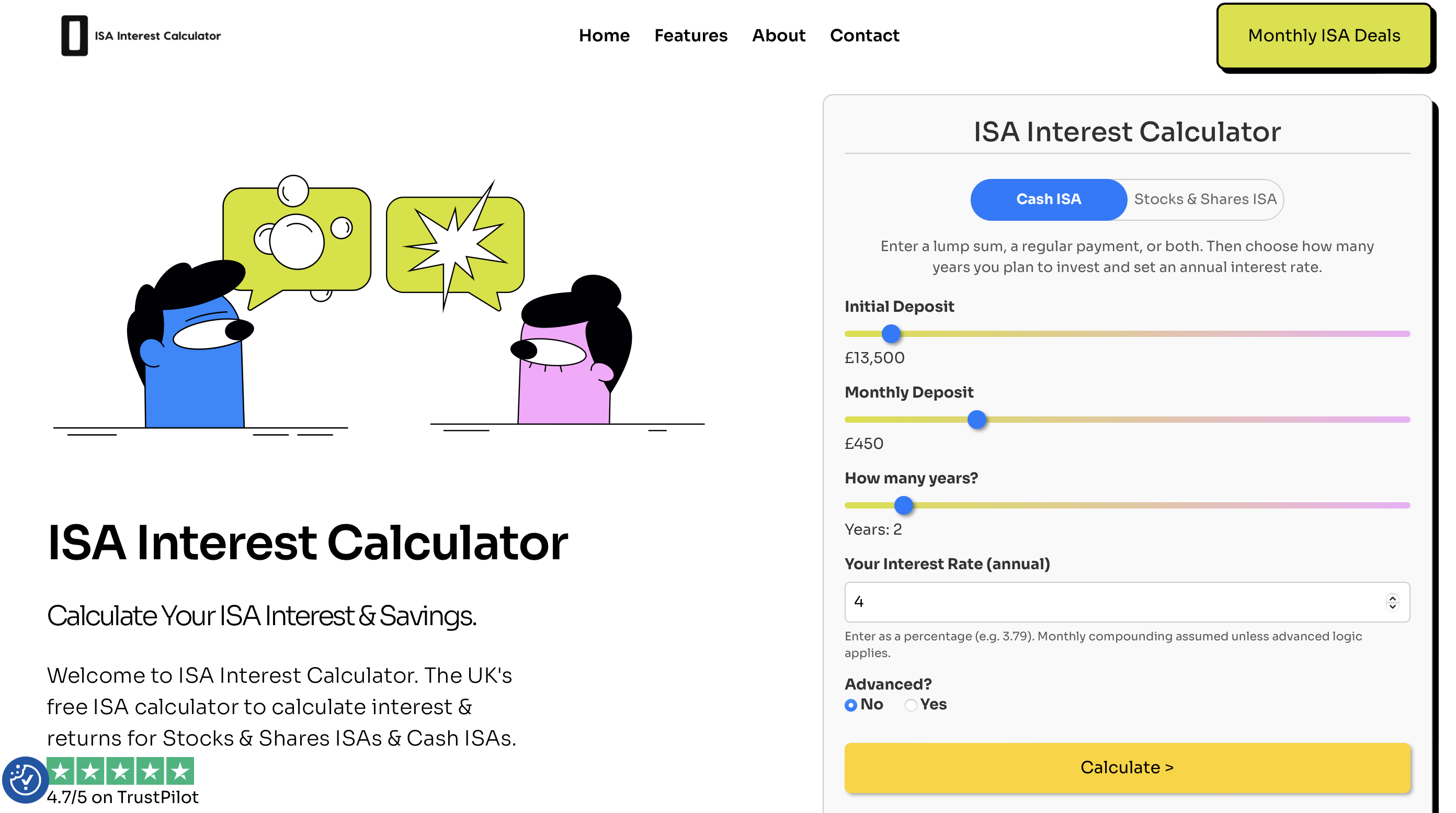

The design is straightforward but pretty nice, so you don’t need a deep financial background to work your way through. Once you’re done inputting your details, you’ll see a visual chart (see above) that plots your potential balance across each year. It’s a good motivator if you’re the type who thrives on seeing the possible end result. Like Nutmeg’s, it’s not exactly tailored to “interest rates” in the Cash ISA sense, but if you’re investigating how to maximise your ISA allowance for investments, this one deserves a look.

Introducing monthly contributions

Another major consideration is the fact that many people don’t just drop in a lump sum at the start of the tax year. Instead, they might deposit £100, £500, or some other amount monthly. So we developed the tool to handle month-by-month compounding. That means if you deposit, for example, £200 every month, those contributions each begin accruing interest or investment returns as soon as they go in, but obviously they won’t benefit from as much total time as your initial deposit. Our calculator tracks these monthly additions, factoring in how each deposit’s interest accumulates from its deposit date.

We did this because we believe it’s essential for budgeting and realistic forecasting. If you’re being paid monthly, you might want to align your ISA contributions with that paycheck. By viewing a month-to-month breakdown, you can see how your total pot grows more smoothly, rather than jumping only once a year.

One extra perk is that the site also explains some basic saving tips and how different YBS accounts work. So if you’re already leaning toward a building society approach, it’s a neat all-in-one spot to do a rough calculation, then check out some of their products. Keep in mind you might have to do your own comparisons if you’re thinking of transferring from an existing ISA or if you want to see how YBS’s rates stack up against others.

Lump-sum deposits vs. monthly combos

Of course, some people like to do both: start with a lumpsum deposit in April, then top up with smaller monthly contributions throughout the rest of the tax year.

We wanted to make that approach easy to model as well. So we allow you to input both a lumpsum deposit (like an initial deposit of £5,000) and a monthly deposit (say £200). The lumpsum starts compounding right away, while the monthly deposits get added over time. This approach gives you a more exact figure for your final balance, rather than ignoring the connection between the lump-sum and subsequent small contributions.

Why we bother with ‘advanced’ toggles

We know not everyone wants to fiddle with advanced toggles. Some folks just want to see, “If I put £10,000 in at 4.0% for three years, what do I end up with?” For that crowd, our standard method of monthly compounding and a single interest rate assumption might be enough. But if you’re a more analytical saver or you have a more complex scenario, those toggles can be invaluable.

In particular, we built toggles for:

-

promotional override

If you say “Yes” to a promotional rate, you can specify how many months it lasts and what the rate is. After that, the calculator transitions to a “base rate” or a “standard rate.” -

variable base rate

If you choose a variable path, the calculator reduces (or sometimes increases, though we often see decreases in a cooled-down economy) the annual rate each year by a certain increment—until it hits the target you set. For example, if you assume the base rate is 4.5% now but will drop 0.5% annually until 2.0%, the calculator gradually steps down the interest accordingly. -

cash vs. stocks & shares

We also separate the scenarios for a Cash ISA (where interest rates are the main driver) and a Stocks & Shares ISA (where you’re dealing with potential returns rather than a set interest). That’s because with Stocks & Shares ISAs, your “rate” is more an expectation of investment returns, and we don’t factor in promotional interest, as that’s not how equity investments typically operate.

The advanced toggles might look a bit intimidating at first, but we noticed a lot of people actually love them once they understand what each toggle does. It gives you a chance to, for instance, see if your monthly deposit strategy outperforms a lump-sum approach under certain rate-change assumptions. Or you can see if a big promotional rate is worth it, even if you suspect the standard rate that kicks in afterward isn’t great.

We consider new ISAs vs. transferring existing ISAs

Another real-life scenario: many people already have an ISA open somewhere else. At the start of a new tax year (or mid-year, if they find a better deal), they might want to transfer all or part of their existing balance. Transferring an ISA is generally easy if you follow the official route, but it could affect how your interest is calculated, especially if you’re transferring from, say, a low-rate or older product into a brand-new promotional product.

While we don’t simulate the transfer process in insane detail (like factoring in the exact day of the month it lands or potential penalty fees from your old provider), we do let you specify whether you’re transferring. The reason is that some users find it helpful to “label” the scenario so they can keep track mentally: Are you opening your very first ISA ever? Are you transferring from one provider to another? Are you depositing a lump sum that’s well within the £20,000 annual allowance, or are you combining your lump sum deposit with a partial or full transfer from a previous year’s ISA?

From a calculation standpoint, it’s not drastically different to say you’re transferring vs. opening your first ISA. But from a user-friendliness perspective, it matters a lot. We wanted to structure the process so you’re not forced to pick one path or the other. Instead, you can reflect your actual situation. That’s one part of making sure the results you see line up with what might happen in real life.

The difference between Cash ISA and Stocks & Shares ISA calculations

When you click through to our calculator, you’ll see we have two main modes: one for Cash ISAs, one for Stocks & Shares ISAs. We approach them differently because they function quite differently in reality:

-

Cash ISA

We base growth on interest rates. This can be a single fixed rate, a variable arrangement, or a promotional scenario. In short, we treat it as a compounding savings product, applying monthly interest. -

Stocks & Shares isa

Rather than interest, we assume you have an annual “potential return.” We’re not guaranteeing anything—stock markets can go down as well as up. But if you believe you might achieve, say, 5% or 6% average annual growth over the next few years, you can input that figure. Then, we’ll apply monthly compounding to reflect how each deposit might earn returns bit by bit.

Obviously, a Stocks & Shares ISA is subject to market fluctuation, so the calculator’s results are more hypothetical. But it’s still helpful to see a rough projection of how a certain monthly deposit could balloon if your annual return meets your expectations.

The reason we specifically separated them is that mixing up interest-based logic with investment-based logic often leads to confusion. Cash ISAs might feature a promotional or variable interest rate, whereas Stocks & Shares ISAs focus on projected returns. Putting both into the same calculation path can muddle the user experience. By giving you a toggle for “Cash” vs. “Stocks & Shares,” we can keep each scenario logically distinct while still letting you easily switch between them.

Personalising your scenario

One reason we include optional fields (like “Is this your first ISA?” or “Are you transferring an ISA?”) is to help you keep track of your scenario in a more personal way. If you’re brand new to ISAs, you might appreciate some extra context in the overview that explains certain basics. If you’re transferring an existing ISA, you might want a subtle reminder that you could face certain restrictions or notice a brief gap in interest if your funds are in transit. We don’t try to be a replacement for reading your provider’s terms, but we hope these prompts keep the process user-friendly and aligned with real-world steps.

Disclaimers: why we insist on them

As proud as we are of this calculator, we always include disclaimers. Why? Because at the end of the day, no one can predict the future with total certainty—especially for Stocks & Shares ISAs, which rely on market performance. We can give you an estimate based on the numbers you enter and the assumptions you make, but real life might look different. Markets can fluctuate, banks can change their rates more or less frequently than you anticipate, and occasionally, new factors pop up (like sudden economic shifts) that can alter the entire picture.

Additionally, if your actual provider charges fees or imposes early withdrawal penalties, that can affect your real returns. Or if you find yourself withdrawing a portion of your ISA mid-year, that changes your balance and thus your final figure. Our disclaimers remind you that, while we factor in many complexities, it’s impossible to cover every scenario a user might encounter in real life.

Why we think you’ll love it

All in all, we poured a lot of thought into capturing the complexities of real-world ISA interest calculations. By weaving in the concept of promotional rates, the potential for a dropping base rate, monthly compounding, lump-sums plus monthly top-ups, new vs. transferred ISAs, and even the intangible influence of inflation, we believe we’ve built a calculator that offers an experience miles beyond the typical “add a deposit, pick a rate, done” approach.

We also hope that if you’re new to ISAs, exploring the different scenarios will help you understand why interest rates matter so much—or how a Stocks & Shares ISA might produce a different (but less certain) outcome. And if you’re a veteran saver, we suspect you’ll appreciate how you can quickly test out various “what if” scenarios, from promotional rates to potential changes interest calculations.

Bottom line

We set out to build the UK’s most accurate ISA calculator because we believe everyone should have the tools to make informed decisions about their savings. After all, your ISA is one of the most powerful vehicles for growing your money tax-free. Why rely on a one-dimensional calculator that ignores the dynamic nature of interest rates, monthly contributions, or promotional periods? By walking you through each factor—base rates, monthly compounding, advanced toggles, lumpsum deposits, and so on—we’ve tried to ensure you’ll see a projection that aligns closely with the real world.

We’ll leave you with one final reminder: The numbers you see in our calculator are estimates. Reality might differ due to unforeseen rate changes, market volatility (for Stocks & Shares ISAs), and any specific fees or conditions from your chosen provider. But when it comes to factoring in the biggest, most consistent drivers of your final ISA balance, we’re confident our approach offers one of the best pictures you can get—short of actually living out the next few years to see the result. So go ahead and test it out. Play with different scenarios, toggles, and time frames. We hope it gives you the insights you need to make the best possible decisions for your personal savings journey.

As a UK trader / investor for over 10 years and avid ISA investor and saver; James decided to build ISA Interest Calculator to help everyday British savers with calculating potential ISA returns. Having worked for a large FTSE100 company building AI tools for over 5 years, he brought his expertise to finance and quickly launched several highly-respected and successful finance & investing sites for UK savers and investors.

2 Responses