ISA Interest Calculators in an AI-Dominated World

OK, excuse the bold title – i even used AI to help me come up with some better ones and this is what i got! But, I’ve been thinking a lot about the future lately—how technology is reshaping nearly every corner of our lives and what that might mean for our finances. Artificial Intelligence (AI) has become the topic of endless headlines, from self-driving cars to predictive algorithms that supposedly know our preferences better than we do. In a world that seems increasingly driven by machine learning and automation, it’s easy to overlook the quieter, simpler tools that have guided our financial planning for decades.

One of those humble yet invaluable tools is the ISA Interest Calculator. As someone who grew up in an era where personal finance was (sometimes!) discussed over kitchen tables rather than guided by online models, I find there’s a certain reassurance in something that remains straightforward, no matter how fast the tech world is spinning.

Why even bother with an ISA Interest Calculator when AI can do it all?

It’s a fair question. Today, AI can rummage through mountains of data, predict market trends, and potentially suggest detailed investment strategies in the blink of an eye. It can tailor advice to our unique spending patterns and risk profiles. In theory, AI could tell us exactly how to optimise every pound we’ve saved.

But let’s pause for a second. Do we really want every bit of our financial planning to be outsourced to an algorithm? There’s an almost meditative quality in stopping, breathing, and running your own numbers, even if that means keying them into a basic calculator. An ISA Interest Calculator is a simple, direct way of understanding how your savings might accumulate over time in a tax-free wrapper—no complicated chatbots, no black-box modelling.

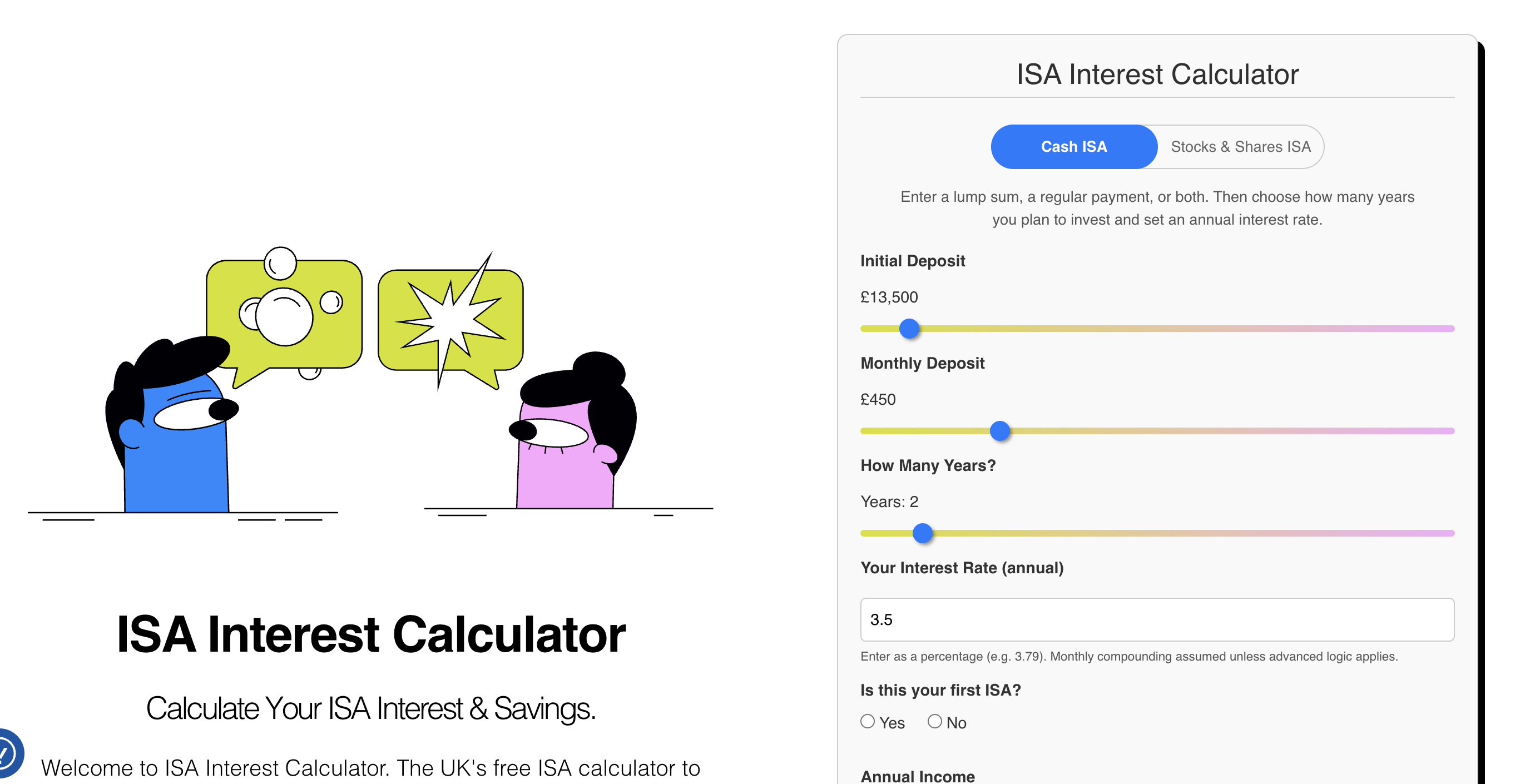

You’re in control. You plug in your initial deposit, your monthly contributions, and an interest rate, then see a forecast of how those numbers might grow over months, years, or even decades. It might not be the cutting-edge approach you’d expect in an AI-saturated age, but it gives you a baseline—a rough and ready gauge that you can trust because it’s not hidden behind layers of machine learning code.

The broader landscape

We’re living in economically turbulent times—rising inflation, fluctuating interest rates, and global events that cause the financial markets to jerk back and forth. I’ve noticed that many of us, understandably, are grappling with uncertainty about where to put our money, how long to fix our rates, and whether to trust any single source of information.

On top of that, there’s an undercurrent of doubt when it comes to technology’s intentions. We hear about data breaches and AI “hallucinations” (when the system generates misleading results). Meanwhile, the simplest of financial tools—a classic interest calculator—remains refreshingly transparent. It’s not about telling you which ISA provider you should choose based on complex analytics; it just helps you see what happens if you deposit X amount at Y rate for Z years.

In times of rapid change, there’s a lot to be said for tools that offer clarity without over complication.

How ISA Interest Calculators stay relevant

There are a couple of ways that ISA calculators, and in fact all kinds of calculator tools might still be relevant – despite the churning tides of AI! Here are just a few:

- They keep your focus on the basics: AI might propose elaborate strategies, but your first priority should often be to understand the core principle of how interest builds up. An ISA Interest Calculator reminds you of the simple truth: consistent contributions and compounding interest remain powerful forces in growing your savings.

- They’re accessible to everyone: You don’t need to be tech-savvy or own the latest smartphone to use an ISA Interest Calculator. This inclusivity means that no one is left behind—even those of us who might be less comfortable with advanced digital tools.

- They encourage personal agency: There’s something empowering about punching in your own numbers, seeing the projected outcome, and then tweaking the inputs to see how slight changes can alter your financial future. While an AI might do all that for you, there’s real value in being hands-on with your finances.

- They act as a bridge: AI is incredible, but it can sometimes feel too big or too clever for everyday tasks. ISA Interest Calculators bridge that gap: they’re a gentle nudge for people who aren’t ready to dive headfirst into AI-driven investment platforms but still want more insight than a simple “here’s the interest rate” statement.

Essentially, calculator tools allow YOU to be in control, you decide the inputs and outputs, you can access them at any time and you don’t get different verbose language every time you try to figure something out. They remain quick, easy-to-use and hopefully designed really well – like ours.

Over-reliance on technology

I don’t mean to sound alarmist—after all, I’m a big advocate for innovation, the hype-cycle all that jazz, I mean i still wouldn’t buy a Tesla, but I’m all for a little gadget. But I often remember a saying that my grandfather used to repeat: “Don’t put all your eggs in one basket.” We’re edging closer to a world where a single technology (AI) could overshadow all our decision-making processes, leaving us vulnerable if it fails or falters.

When we rely on an AI to manage every facet of our finances, from budgeting to retirement planning, there’s a risk of losing our grip on how the system actually works. An ISA Interest Calculator may not be a sophisticated piece of technology (I mean it was still pretty tricky to build!), but it does one important thing: it keeps you in the driver’s seat. It’s a straightforward reflection of the numbers you input, and it helps you maintain a level of financial literacy that can vanish if we let algorithms do all our thinking for us.

A global perspective on simple tools

It’s not just in the UK where people are wrestling with these shifts. Around the globe, savers and investors are looking for stable ground in a volatile economic environment, and many are turning to digital tools for guidance. Yet, time and again, simple, user-friendly calculators prove their worth in every language and every currency.

For instance, a friend of mine in Australia told me how she used a local version of an “interest calculator” to wrap her head around her savings. She made no mention of advanced AI forecasts, even though they were available. Instead, she trusted the calculator’s simplicity—no hidden agendas, no marketing ploys—just raw data to help her plan.

My personal takeaway

In a world that sometimes feels overshadowed by algorithms and robo-advisers, it’s reassuring to know that the humble ISA Interest Calculator is still there, steadfastly doing what it does best: showing you how your savings could grow under varying interest rates and timeframes.

There’s a place in our modern financial toolkit for both the old and the new. AI can enhance our understanding and deliver complex forecasts, but there’s real strength in maintaining some direct control—and ensuring we truly grasp the fundamentals. I’ve found that using these calculators can even make me feel more confident about dabbling in AI-driven financial tools later, because I know the underlying math and assumptions behind any fancy predictions.

Final thoughts

So even as AI steps into the limelight—promising the moon and the stars in predictive power—the uncomplicated reliability of something like an ISA Interest Calculator still has immense value. It offers a reminder of what personal finance is really about: building a nest egg, understanding compounding (here’s our article on that!), and making decisions that suit our own comfort levels and aspirations.

Ultimately, embracing both the innovative potential of AI and the simplicity of a calculator is a balancing act that can keep us grounded. And in an ever-changing economic landscape, who couldn’t use a bit more grounding?

As a UK saver & investor for over 10 years and avid ISA user; James decided to build ISA Interest Calculator to help everyday British savers with calculating potential ISA returns. Having worked for a large FTSE100 company building financial AI tools for over 5 years, he brought his expertise to personal finance and quickly launched several highly-respected and successful finance & investing sites for UK savers and investors.