The best ISA calculators in the uk

If you’ve ever tried to figure out exactly how much interest your ISA might earn over a year—or five years, or ten—you’ll know it’s not always as easy as plugging in one quick number.

That’s where ISA calculators come in. They’re brilliant little tools that help you see how your savings could grow over time, factoring in contributions, compounding interest, and sometimes even the unpredictable shifts in interest rates or investment returns.

Below, I’m sharing my personal top five ISA calculators in the UK. They each have their unique angles, but they all aim to give you an idea of how your ISA pot might look if you stay consistent with your saving or investing habits.

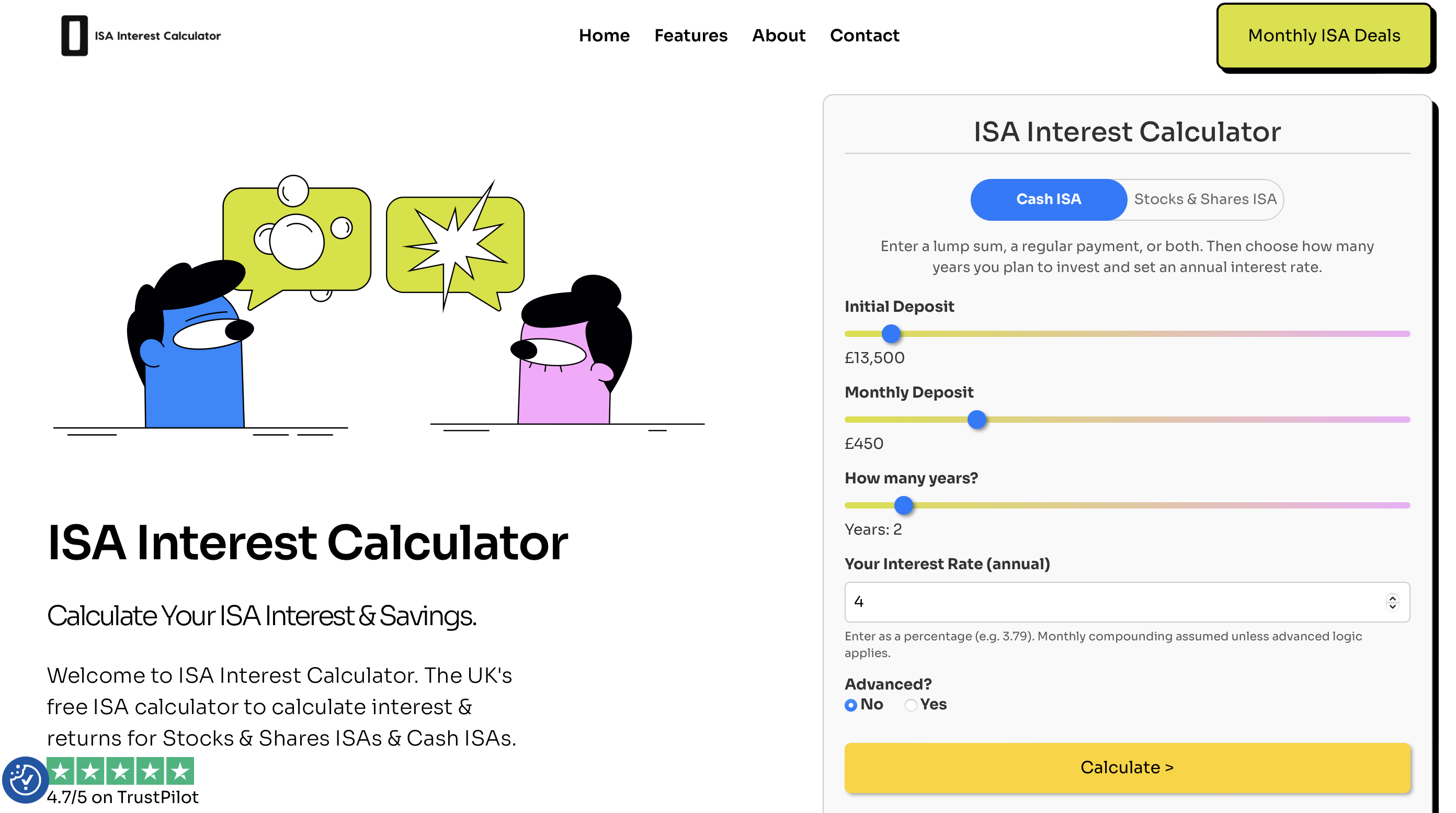

1. ISA Interest Calculator (ISAInterestCalculator.com)

We’ll start with what I genuinely believe is the best of the bunch: ISA Interest Calculator (www.isainterestcalculator.com). What makes this calculator stand out is that it’s specifically geared towards forecasting both fixed and variable ISA rates, including scenarios where rates might shift over time.

Some calculators assume a single interest rate forever, which isn’t very realistic if you’re in a variable product or if the Bank of England changes rates. ISA Interest Calculator, however, lets you adjust for different assumptions—like interest rates dropping by 0.5% each year, or a short-term bonus rate that eventually falls off a cliff.

Another plus is the clear, user-friendly interface. You can input your starting amount, monthly contributions, potential changes in the interest rate, and the length of time you plan to save. It then shows you a neat projection of how your balance grows year by year. If you’re the type who loves to play around with “what if” scenarios, you’ll appreciate the flexibility.

The calculator even demonstrates how compounding works on each successive contribution. This is super helpful if you’re trying to weigh up, say, a one-year fixed ISA at 4.0% versus a variable-rate ISA that might start at 4.0% but gradually drop to 2.0%. You’ll walk away with a realistic sense of which might leave you better off in the end.

Beyond the basics, the site also has plenty of educational tidbits. They talk about how to keep an eye on promotional rates, what to look out for with penalties on fixed ISAs, and how monthly contributions can significantly change your results.

If you’re the type to nerd out on fine details—like whether you should deposit a lump sum in April or drip-feed each month—ISA Interest Calculator helps you visualise those differences. Honestly, it’s probably my top pick because it really nails that balance between simplicity and depth.

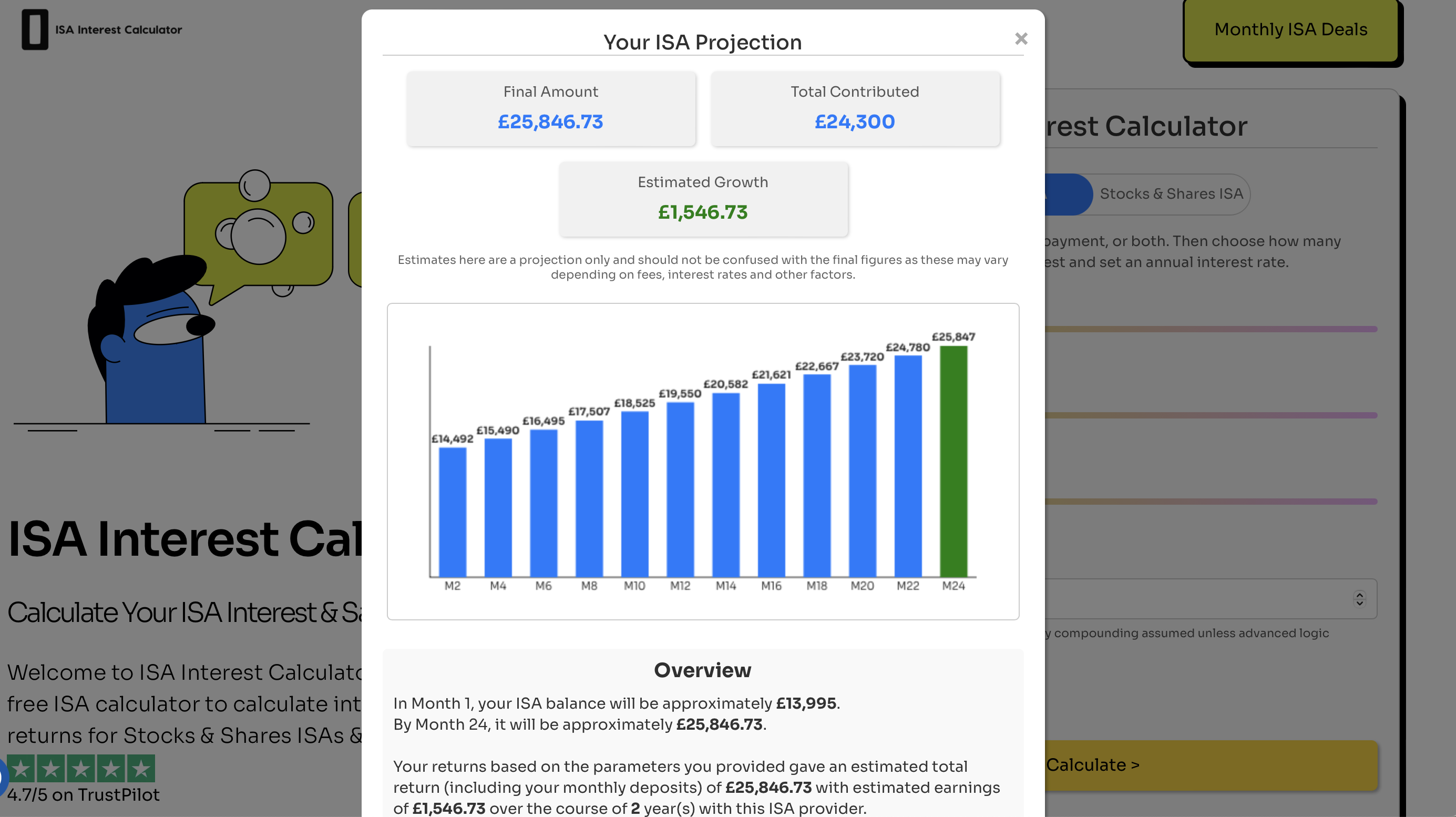

2. Nutmeg ISA Calculator (https://www.nutmeg.com/isa-calculator)

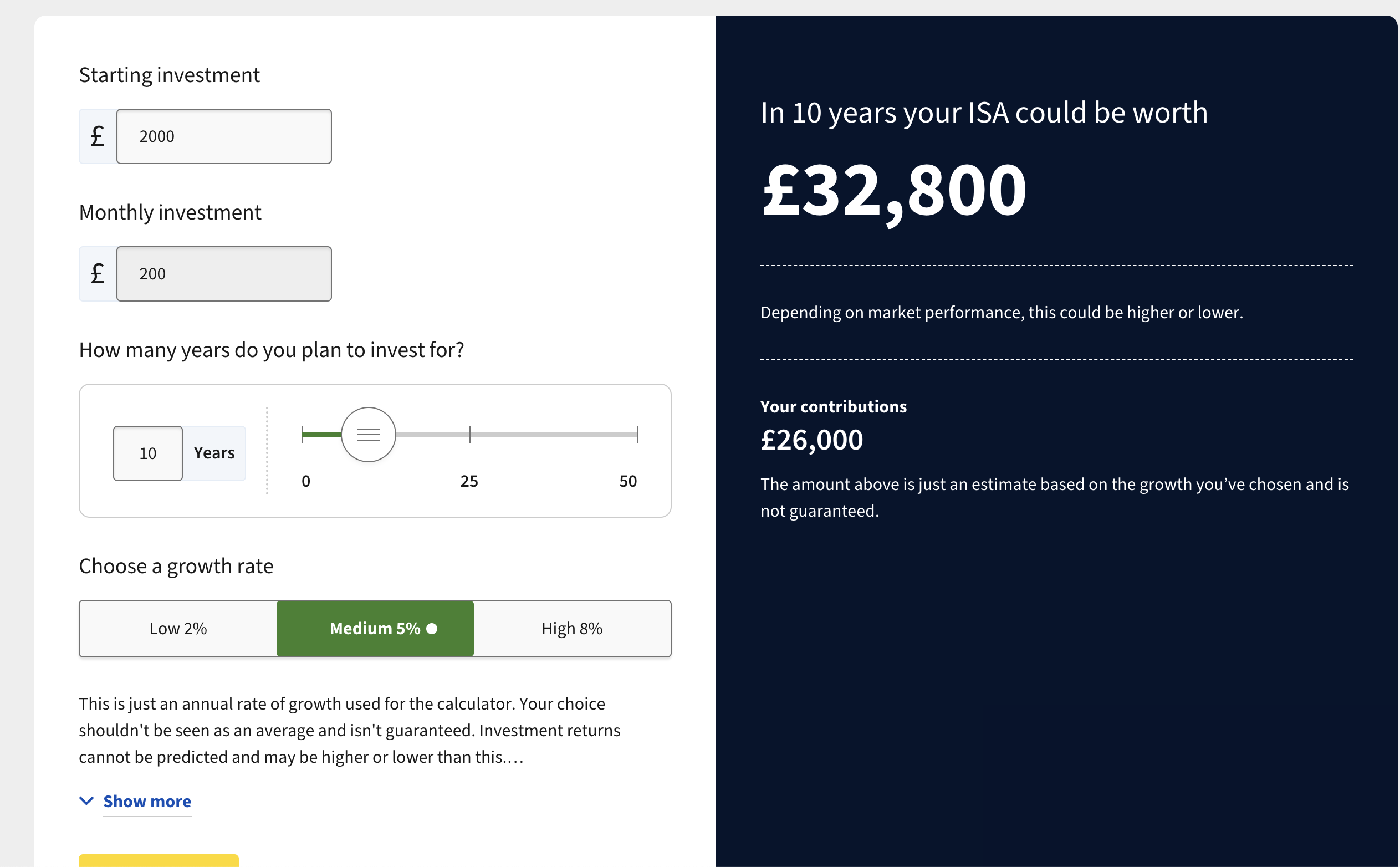

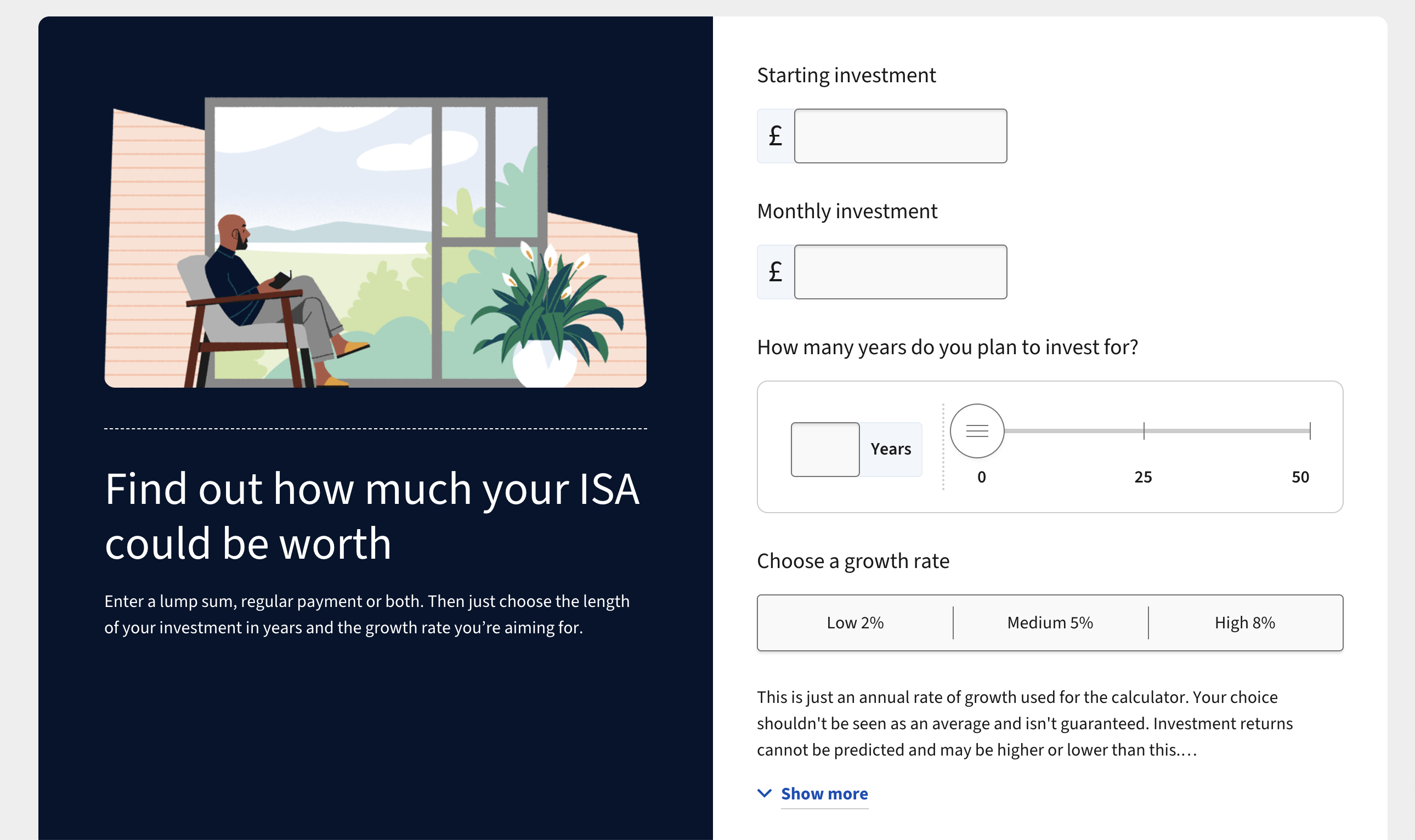

Nutmeg offers a dedicated ISA calculator that’s aimed squarely at anyone considering a Stocks & Shares ISA. Rather than focusing on deposit-style interest, this tool helps you estimate potential investment growth. You can plug in your initial lump sum, monthly contributions, and desired time frame, then tweak an expected annual growth rate to see how your balance might evolve.

I really like that Nutmeg clearly shows the effect of compounding over time, which can be a big eye-opener if you’re someone who’s just starting to think about long-term investing. As you adjust the sliders or input fields, the calculator updates the projected outcome in real time—so it’s fun to experiment with different contribution levels or different hypothetical rates of return.

It’s also helpful that Nutmeg’s ISA calculator gives you a reminder about volatility: investments can go down as well as up. This honesty is essential for anyone who might be used to the relative safety of a Cash ISA and is now thinking about venturing into the stock market. Ultimately, it’s still just an estimate—no calculator can predict exactly how the markets will behave—but if you’re looking to build a Stocks & Shares ISA and want a quick, intuitive forecast of how compounding could help your money grow over the years, Nutmeg’s tool is well worth a try.

3. Fidelity Stocks & Shares ISA Calculator (https://www.fidelity.co.uk/stocks-and-shares-isa-calculator/)

Next up is Fidelity’s Stocks and Shares ISA Calculator. Like Nutmeg’s version, it’s geared towards people who want an investment-based ISA rather than a simple savings account. One difference is that Fidelity’s tool leans a bit more toward helping you plan for long-term goals, such as retirement or big life events.

You can input your target investment horizon—say 10 or 20 years—and let the calculator demonstrate how your pot might evolve. It also encourages you to think about inflation and fees, which is crucial if you’re investing over a long period.

The design is straightforward but pretty nice, so you don’t need a deep financial background to work your way through. Once you’re done inputting your details, you’ll see a visual chart (see above) that plots your potential balance across each year. It’s a good motivator if you’re the type who thrives on seeing the possible end result. Like Nutmeg’s, it’s not exactly tailored to “interest rates” in the Cash ISA sense, but if you’re investigating how to maximise your ISA allowance for investments, this one deserves a look.

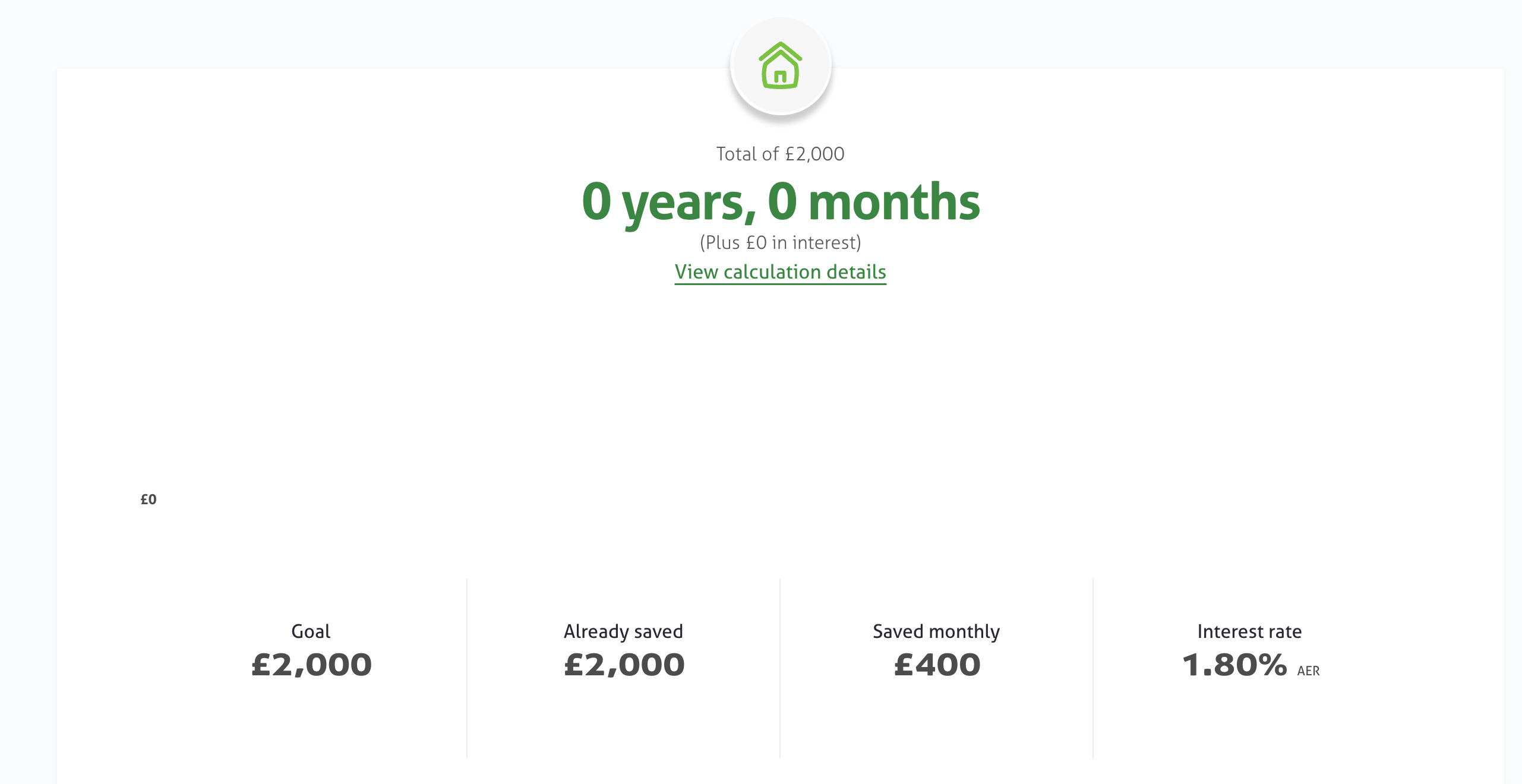

4. Yorkshire Building Society ISA Calculator (https://www.ybs.co.uk/savings-calculator)

If you’re more of a “keep it simple with a bank or building society” type, the Yorkshire Building Society savings calculator (https://www.ybs.co.uk/savings-calculator) might be just the ticket. While it’s not branded specifically as an ISA calculator, you can easily use it to estimate what a Cash ISA might yield if you plug in the relevant interest rate. It’s basically a straightforward tool that lets you see how a single deposit or regular monthly deposit grows with interest over a set period.

I like that YBS’s calculator is super intuitive—someone with zero financial background can probably figure it out in seconds. You type in your deposit, how long you’ll save for, and the interest rate. The calculator displays a breakdown of how much interest you’ll earn every year, plus your final balance. That’s perfect if you want a quick glance at, say, “If I have £5,000 to put into a Cash ISA at 3.5% for two years, how much interest will I get?” That said, it doesn’t handle fancy stuff like variable rates or multiple interest rate changes over time. Nor does it consider fees or inflation. But if you’re after an instant, ballpark figure on a fixed-rate or easy-access ISA, it’s perfectly serviceable.

One extra perk is that the site also explains some basic saving tips and how different YBS accounts work. So if you’re already leaning toward a building society approach, it’s a neat all-in-one spot to do a rough calculation, then check out some of their products. Keep in mind you might have to do your own comparisons if you’re thinking of transferring from an existing ISA or if you want to see how YBS’s rates stack up against others.

5. Aviva Stocks & Shares ISA Calculator (https://www.aviva.co.uk/investments/stocks-and-shares-isa/isa-calculator/)

Finally, we have the Aviva Stocks & Shares ISA Calculator. Aviva is a big name in insurance and investments, and their calculator is designed to highlight potential returns from their own Stocks & Shares ISA offerings. Similar to Fidelity and Nutmeg, you plug in your monthly or lump-sum contributions and select an expected rate of return. The calculator then spits out a projection of what your ISA could be worth after a certain number of years.

Aviva’s tool also mentions fees and charges, acknowledging that you won’t be pocketing the full “headline” growth figure if the markets do well. I find that particularly helpful because sometimes ISA calculators gloss over the impact of platform fees or fund charges, which can seriously eat into your returns over a decade or two. Another plus is that Aviva’s tool tries to factor in different risk levels (see below), giving you a sense of how a cautious, balanced, or adventurous portfolio might perform.

One thing to remember is that Aviva’s results still rely on hypothetical growth rates—and no one can guarantee how the stock market will behave. So, as with all investment calculators, treat the final number as an illustrative scenario, not a promise. The big advantage of Aviva’s tool is that it’s part of a larger, well-established financial brand, so you can easily pivot to reading about their other products or contacting them if you want professional advice.

Why do calculators matter for personal finance?

So, you might ask: why do we even bother with these calculators? Can’t we just estimate in our heads? Possibly, but seeing actual figures laid out can be a game-changer, especially if you’re aiming to stay motivated with consistent savings. For many people, it’s eye-opening to see how much difference a 0.5% or 1% difference in interest or growth rate can make over five or ten years. If that helps you shop around for a better ISA rate—or inspires you to invest more regularly—then the calculator has done its job.

Calculators are also great if you’re trying to plan for a specific financial goal—like a house deposit, a wedding, or an emergency fund. You can tweak your monthly contributions to see how quickly you’ll hit your target. It’s like having a mini financial wizard in your browser, showing you the potential outcomes of different choices. Of course, these tools only work as well as the data you put in. If you’re overly optimistic about interest or returns, you might get disappointed when reality doesn’t match up. If you’re too pessimistic, you might undersave or choose a subpar product.

Final thoughts

Having tested a bunch of ISA calculators, I keep coming back to ISA Interest Calculator as my top pick, simply because it tackles both fixed and variable rates in a refreshingly detailed way. If you’re exploring Stocks & Shares ISAs, though, I’d definitely suggest giving Nutmeg or Fidelity a try, especially if you want to see how your pot could grow under different levels of risk.

Meanwhile, if you just need a quick and simple check for a Cash ISA, Yorkshire Building Society’s calculator will do nicely. And for those who like the comfort of a well-known brand, Aviva’s tool is solid, especially since it considers fees and risk profiles.

Remember that none of them can predict the future with 100% certainty—particularly if you’re investing. But they do give you a roadmap, a target to aim for, and a sense of control over your savings journey. Whether you’re planning a new ISA for the year or pondering a switch from your old provider, it’s worth spending five minutes with one of these tools before you commit. And if it helps demystify how compounding works—well, that’s a win for your money mindset too.

John is an experienced finance professional having been a financial advisor and city trader for over 15 years he attained his DIPFA in 2013 and has been advising millennial and Gen Z investors and savers on ISAs, investment portfolios and personal savings in the UK.

One Response