What is an ISA?

An ISA—short for Individual Savings Account—is a (as you may know!) one of the most popular ways for UK residents to save or invest money without paying tax on any interest or investment gains they earn. If you’ve been hearing the term “ISA” everywhere and wondering what all the fuss is about, I’m about to walk you through the history, the mechanics, and why that annual £20,000 limit exists in the first place.

The origins of ISAs

ISAs were introduced in April 1999 (over 26 years ago now..) by the then Chancellor of the Exchequer, Gordon Brown. They replaced earlier savings vehicles called PEPs (Personal Equity Plans) and TESSAs (Tax-Exempt Special Savings Accounts). The aim was to simplify tax-free saving and make it more accessible to a wider range of people. Ask your Dad or Mum they might remember these PEP & TESSA days…

Over time, ISAs evolved – with new types of ISAs being added (for example, the Lifetime ISA in 2017), and allowances (the maximum you can save each year) being adjusted.

Who offers ISAs, and who regulates them?

So there are a couple of key players involved in ISA’s, the banks, the investment platforms and the HMRC. They all have the following roles to play:

- banks and building societies: In practice, you’ll see ISAs offered by high street banks, online-only banks, and building societies. Each institution designs its own ISA products—fixed-rate, variable-rate, stocks and shares, etc.

- investment platforms: For stocks and shares ISAs, you might use online brokerages or investment platforms that allow you to hold a range of funds, shares, and other assets.

- oversight: HM Revenue & Customs (HMRC) sets the rules for ISAs—what counts as a valid ISA, how much you can contribute each year, and what kind of tax benefits apply. Providers must comply with these regulations to be officially recognised as ISA providers.

The £20,000 annual limit

Every tax year (running from 6 April to 5 April), you can put up to £20,000 into ISAs. You can split this across different types of ISAs—cash, stocks and shares, Lifetime, or Innovative Finance—but the total amount you contribute can’t exceed £20,000 for that year.

- Why £20,000?

The government sets the annual allowance to strike a balance between encouraging people to save and invest for the future—tax-free—while also limiting the overall tax break cost to the public purse. The allowance has changed a few times over the years, but it’s been £20,000 since the 2017–18 tax year.

- Historical allowances

When ISAs first began in 1999, the annual limit was much lower. Over time, successive Chancellors have raised the allowance, reflecting inflation and the government’s desire to incentivise personal saving.

While this limit seems quite large, the fact that it’s remained at this level since 2017 does say something about stagnating wages and low growth in the UK economy – most other major economies who experience high-growth and high inflation, would raise the personal savings limit in order to meet inflation.

The allowance jumped to £20,000 in the 2017–18 tax year. Before that, it was £15,240 (in 2016–17). Back in the early days (around 1999), the ISA allowance started out much lower (initially around £7,000 for the stocks and shares component and £3,000 for the cash component, though it had a slightly different structure). It has crept up over the decades, sometimes in line with inflation, other times to give savers a bigger incentive.

How an ISA actually works

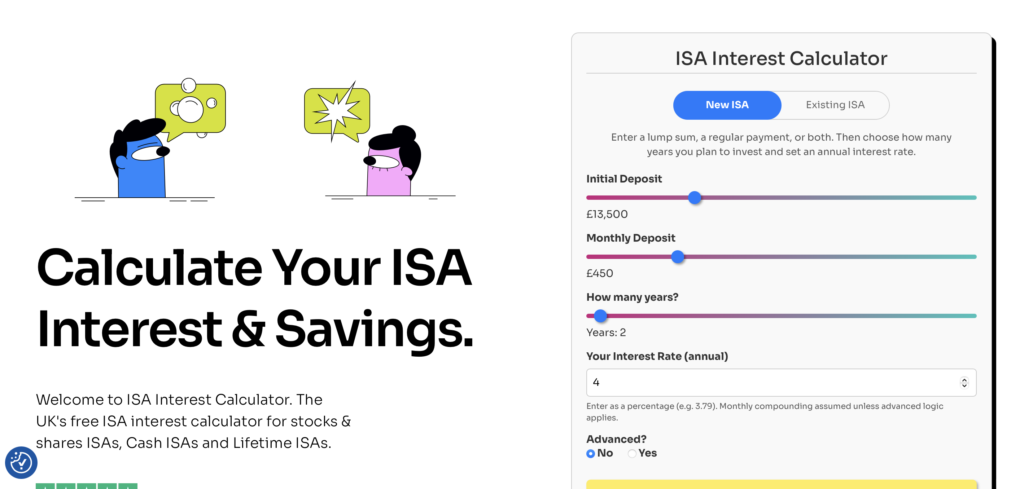

We explore this in a little more detail in our article about ‘How to get started with ISAs’ but just to touch on it here, here’s how to get started:

- Choose a type

You can opt for a cash ISA (savings account with tax-free interest) or a stocks and shares ISA (investments in funds, shares, bonds, etc. with tax-free growth). There are also Lifetime ISAs (for first-home buyers or retirement savings) and Innovative Finance ISAs (peer-to-peer lending). - Deposit money

Each tax year, you can deposit up to the allowance (currently £20,000). You can spread that across multiple ISA types but still can’t exceed £20,000 in total. - Earn returns tax-free

Any interest, dividends, or capital gains you earn within your ISA remain free from UK tax. You don’t even have to report them on your tax return. - Accessing your money

With a cash ISA, you can usually withdraw any time—unless you chose a fixed-rate account with penalties for early withdrawal. With a stocks and shares ISA, you can sell your investments, but the actual market price of assets might go up or down.

Why are ISAs so popular?

There are a couple of key reasons why parents keep asking you to stash away a few extra quid in the ISA over the years:

- Tax-free returns

This is the big draw. Any interest or gains you earn stays yours—no need to worry about additional income tax or capital gains tax. - Flexibility

ISAs come in several forms, giving you a range of choices: from straightforward cash accounts to more adventurous stock-market-based investments. - Simplicity

Unlike other investments that can involve complex tax implications, ISAs are straightforward. You don’t have to fill out extra forms for your gains or interest at the end of the tax year. - Encouragement to save

Because there’s a set allowance each year, many people feel motivated to “use it or lose it.” Whatever you don’t use by 5 April doesn’t roll over.

Final Thoughts and some key takeaways

ISAs have a rich history, beginning as an effort to simplify tax-free saving back in 1999. Over the years, both the allowance and the types of ISAs available have expanded significantly, helping millions of UK residents save and invest for their futures. The £20,000 limit might feel like an arbitrary figure, but it’s part of a balance the government strikes to encourage saving while managing tax revenues.

If you’re looking to save or invest tax-free, understanding the fundamentals—and the history—of ISAs is a great first step. Then you can choose which type of ISA best fits your financial goals and make the most of each year’s allowance before it resets.

Key takeaways

- ISAs started in 1999, replacing older tax-free savings products.

- They’re overseen by HMRC, which sets the rules and allowances.

- The annual limit is currently £20,000, a figure that’s been in place since 2017–18.

- You can split this allowance across various ISA types—cash, stocks and shares, Lifetime, or Innovative Finance.

- ISA interest and returns are tax-free, making them a top choice for UK savers.

As a UK saver & investor for over 10 years and avid ISA user; James decided to build ISA Interest Calculator to help everyday British savers with calculating potential ISA returns. Having worked for a large FTSE100 company building financial AI tools for over 5 years, he brought his expertise to personal finance and quickly launched several highly-respected and successful finance & investing sites for UK savers and investors.